Latest news

World Security Report Executive Insights

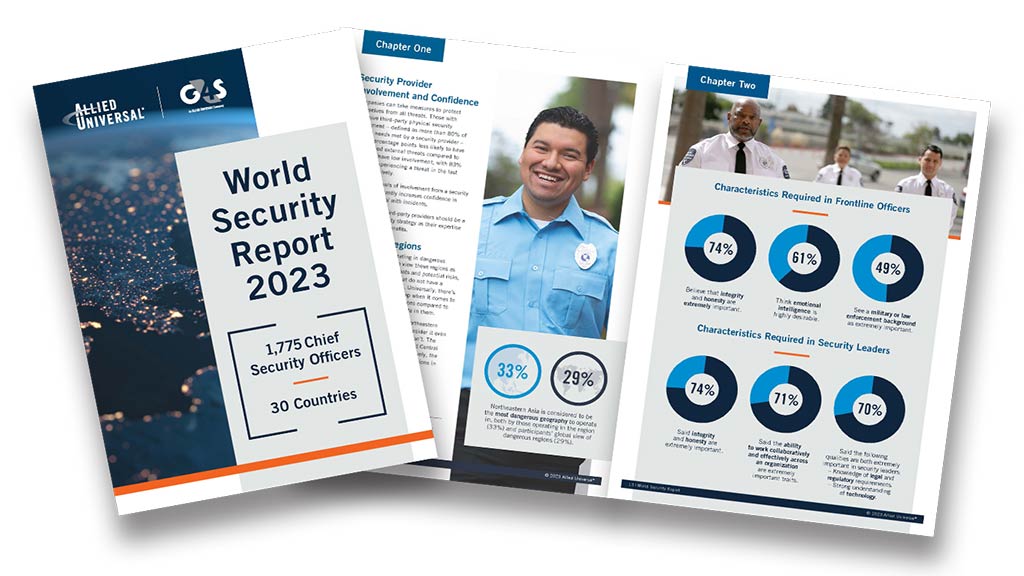

Discover key insights from Allied Universal global chairman and CEO, Steve Jones, and Ashley Almanza, Allied Universal executive chairman of G4S, Allied Universal's international business.

Key Findings

Landmark research on world security gauged opinions of 1,775 chief security officers based in 30 countries on the biggest security-impacting hazards in the next 12 months.