2018 Half Year Results

G4S Chief Executive Officer Ashley Almanza commented:

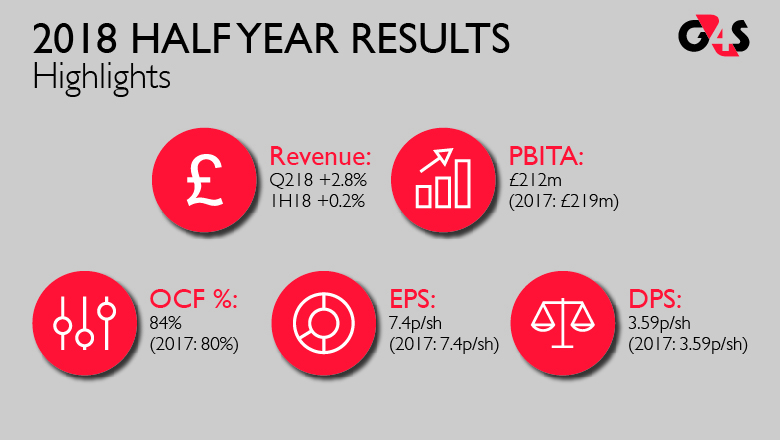

“As anticipated, the Group delivered a marked improvement in revenue generation in the second quarter, with organic growth of 2.8% resulting in half year organic growth of 0.2% against demanding comparatives”.

“Our contract wins and strong retention rate in the first half of 2018 provide revenue momentum into the second half of the year. This, together with growing technology-enabled services in both our cash and security businesses, a favourable sales mix and planned productivity benefits, underpins the Group’s positive outlook for the full year”.

First half highlights (Underlying resultsa unless otherwise noted):

• Step change in revenue growth in second quarter

• New contract wins of £0.7 billion (annual contract value)

• Secure Solutions margin 5.9% (2017: 5.9%); service mix and productivity offset wage inflation

• Cash Solutions margin 10.7% (2017: 11.0%); reflecting increased business development and operating costs

• Operating cash flow conversion 84% (2017: 80%), in line with seasonal norm

• Net debt to EBITDAb 2.7x (30 June 2017: 2.7x)

• EPSa,c 7.4p (2017: 7.4p); Interim dividend: 3.59p per share (2017: 3.59p)

• Statutory results reflect businesses sold and exchange rate movements - see page 9

Full year outlook

• First half contract wins and strong retention rate provide second half momentum

• Technology-enabled services, favourable sales mix and productivity benefits underpin full year outlook

• Expect net debt to EBITDAb=<2.5x FY18

Group results – first half

|

|

Underlying Resultsa |

Statutory Resultsd |

||||

|

|

In Constant Currency |

Actual Rates |

||||

|

|

2018 |

2017 |

% |

2018 |

2017 |

% |

|

|

|

Restatede |

|

|

Restatede |

|

|

Revenue |

£3,599m |

£3,591m |

+0.2 |

£3,672m |

£3,971m |

(7.5) |

|

Adjusted PBITAb |

£212m |

£219m |

(3.2) |

£213m |

£238m |

(10.5) |

|

Adjusted PBITAb margin |

5.9% |

6.1% |

|

5.8% |

6.0% |

|

|

Earningsc |

£115m |

£115m |

- |

£103m |

£151m |

(31.8) |

|

Earnings Per Sharec |

7.4p |

7.4p |

- |

6.7p |

9.8p |

(31.6) |

|

Operating Cash Flow |

£179m |

£183m |

(2.2) |

£165m |

£170m |

(2.9) |

a Underlying results are Alternative Performance Measures as defined and explained on page 36. They are reconciled to the Group’s statutory results on page 4. The underlying results are presented at constant exchange rates other than for operating cash flow where operating cash flow for 2017 is presented at 2017 actual rates.

b Adjusted PBITA and net debt to adjusted EBITDA are Alternative Performance Measures as defined and explained on page 36. The Net debt to adjusted EBITDA ratio is calculated as set out on page 39.

c Earnings is defined as profit attributable to equity shareholders of G4S plc. Underlying earnings and underlying earnings per share (“EPS”) are adjusted to exclude specific and other separately disclosed items, as described on page 37, and are reconciled to statutory earnings and EPS on page 4.

d See page 21 for the basis of preparation of statutory results.

e Restated for the adoption of IFRS15 – Revenue from Contracts with Customers, see note 3.

G4S STRATEGY AND INVESTMENT PROPOSITION

G4S is the world’s leading, global integrated security company, providing security and related services across six continents.

Our strategy addresses the positive, long-term demand for security services. Our enduring strategic aim is to demonstrate the values and performance that make G4S the company of choice for customers, employees and shareholders. We aim to do this by delivering industry-leading innovative solutions and outstanding service to our customers, by providing engaging and rewarding work for employees and by generating sustainable growth and returns for our shareholders.

Organisation

Our portfolio programme is substantially complete and we now have a much more focused business. Over the past four and a half years we have invested in sales, business development, technology and support and control functions. With sufficient strength and depth in these areas, we re-organised the Group on 1 January 2018 to:

• Consolidate our Secure Solutions businesses into four regions: Africa, Americas, Asia and Europe & Middle East

• Create a global Cash Solutions division

Our new organisation enables us to strengthen further our strategic, commercial and operational focus in each of our core service lines. We will continue to build and utilise shared services for the provision of efficient and fit-for-purpose support functions to all businesses and this element of our organisational development has significant unrealised potential.

We are implementing a productivity programme which is designed to deliver £90 million - £100 million of recurring cost savings by 2020. A portion of these gains will be re-invested in growth, with the majority expected to benefit the bottom line:

• The financing efficiency component of around £20 million has been secured through refinancings completed this year and the benefits will begin to flow through to profits in 2019.

• The operational and overhead components which are expected to deliver £70 million to £80 million of savings by 2020 have, to date, been largely re-invested in sales, business development and enhanced support and control systems. From the second half of this year the savings will begin to make a net contribution to profits.

Business Segments, Service Lines and Regions

The Group has two business segments, Secure Solutions and Cash Solutions, each with a number of key service lines.

Secure Solutions

• Security Solutions incorporating risk consulting, manned security, facilities management services, software and systems and integrated security solutions

• Care & Justice services including custody, detention and transportation

Security Solutions (77% of group revenuesa): G4S delivers industry-leading security services and facilities management in around 90 countries around the world.

Building on our established security services, we have invested in developing the capabilities to design and deliver security technology, security systems and integrated security solutions that combine people and technology to offer our customers more efficient and valuable security solutions. We believe that the ability to design and deliver technology-enabled security solutions strengthens our customer-value proposition and provides G4S with the opportunity to increase the longevity and grow the value of existing customer relationships, win new business and earn higher margins.

In the first half of 2018, 42% (FY 2017: 39%) of our Secure Solutions revenues were derived from technology-enabled security services which combine our people with technology. We have established a substantial business selling technology-enabled solutions to larger customers. With success in that segment, we are extending our offering into the medium sized customer market.

Care & Justice services (7% of group revenuesa): G4S’s Care & Justice services are concentrated in the UK and Australia where we have built significant knowledge and expertise in delivering complex public services. Our strategic focus is on selective, profitable growth and operational delivery and achieving positive outcomes for those using the services. We expect significantly-improved cash generation from our Care & Justice services over the next 12-18 months as we continue to be highly selective in bidding and negotiating for new business and as certain legacy contracts expire or otherwise improve.

Cash Solutions

• Cash in transit, cash processing and ATM services

• Cash Technology services, comprising:

o Cash and non-cash management software and services

o Smart safes and cash-recycling technology

In our Cash Solutions business (16% of group revenuesa), we provide software, hardware, systems and services that improve the security, control and efficiency of our customers’ cash handling. Whilst cash usage is expected to continue to grow in emerging markets, in developed markets cash volumes are expected to gradually decline.

To ensure critical mass and economies of scale, we focus on markets where we have, or can build a number one or number two position in the market. We aim to grow volumes in traditional cash services of cash-in-transit and ATMs organically through cost leadership which enables us to win market share and encourages banks to outsource more services.

We believe that the Group is well positioned to address a substantial and valuable opportunity to extend and grow our new products and services that are being adopted by banks and some of the world’s leading retailers. We expect this market to continue to grow strongly and we have market-leading innovative products combining software and service.

We are making significant progress with large retailers with what we refer to as our “big box” solution and we are also seeing increasing interest in our mid-size and small box offerings. We believe that our Cash Technology services have the potential to produce profits greater than the global profits from our traditional cash business in the medium term.

At 30 June 2018, we had over 21,500 (December 2017: 19,500) cash automation locations, a 10% increase since the year end, across North America, Europe, Asia Pacific and Africa. Industry research data indicates that the total addressable market for smart safes and recycling solutions is around £20-25 billion per annum.

Financial Outlook

G4S Group Chief Executive Officer, Ashley Almanza, commented:

“Since 1 January, the creation of a global cash division and consolidation of our Secure Solutions regions are providing us with the strategic, commercial and operational focus needed for the next stage of the Group’s development. Combining technology with our established security offering is strengthening our sales mix and contract retention, whilst the rapid development of our cash technology business has the clear potential to deliver profits greater than the global profits of our traditional cash business in the medium term”.

“We intend to remain soundly financed with operating cash conversion of more than 100% of Adjusted PBITA and a net debt to Adjusted EBITDA ratio of 2.5x or less. Priorities for excess cash will be investment, dividends and, in the near term, further leverage reduction”.

a Underlying results are reconciled to statutory results on page 4, and an explanation of Alternative Performance Measures (“APMs”) is provided on page 36.

b Source: Company research and 3rd party data including RBR, Panteia, Euromonitor International, World Retail Data and Statistics.

Read the full announcement here (PDF 1705 KB)